Articles

After you go to a financial, whether in person otherwise on the internet, and discover the new FDIC Formal Sign, you are aware the lending company try backed by the full faith and you may borrowing of the All of us https://mrbetlogin.com/big-bad-wolf/ regulators, which your bank account to your put is secure. In order to enhance FDIC exposure past $250,100000, depositors have other options along with trust accounts. For each beneficiary of the trust may have a $250,one hundred thousand insurance coverage limit for four beneficiaries.

To possess a keen HSA dependent because of the an employer to own staff, the newest FDIC do insure the newest HSA as the a member of staff Work for Plan Membership. The new FDIC find whether such standards try satisfied during the time of an insured lender’s inability. Such, the newest FDIC guarantees dumps belonging to an excellent homeowners’ relationship in the one covered financial to $250,100000 altogether, maybe not $250,100 for each member of the new relationship.

StashAway have managed so it large rates away from December 2023. The newest frequency of your interest costs could also connect with exactly what repaired rate of interest your’lso are provided on your term put. You’re able to choose between finding the desire earnings month-to-month, quarterly, half-annual, a-year or in the readiness (after the word). Generally, the more seem to you want the interest paid, the low the interest rate you are provided on the an excellent term put. For those who have more $one million that you’lso are looking to spend money on an expression deposit, you could examine the interest prices, provides and you can benefits associated with the brand new readily available also offers, up coming speak to for each bank personally for more information.

A specialist in your mind, she will get a great kick away from extracting state-of-the-art money principles to your everyday Singaporean. When Vanessa’s not debunking financing myths, you’ll see the woman likely to dance classes, fingerpicking a guitar, or (very impawtently) satisfying their existence goal and then make her one-eyed cat the most bad and you can loved kitty around the world. But with $10,100, you’d be much better of vehicle parking your money that have CIMB to possess 90 days to locate dos.40% p.a.

Put Insurance Financing

Prices can also drop suddenly, leaving an excellent “bait-and-switch” effect. Whenever several covered banks merge, places on the assumed bank is separately insured from places at the the fresh just in case financial for around half a year after the merger. Which sophistication months gives a depositor the opportunity to restructure their or her account, if required. Whether or not financial servicers often collect taxation and you will insurance coverage (T&I), these types of profile is actually individually was able and not experienced mortgage repair profile to own deposit insurance aim. T&We deposits fall into the new debtor’s pending payment of their a home fees and you may/otherwise possessions top to the taxing authority or insurance provider. The brand new T&I places is actually covered on the a great “pass-through” basis to the consumers.

3 Necessary Files

A safety deposit form you can keep all the or a percentage of one’s currency to cover cost of clean up. You don’t need demand funds from the new visitor pursuing the reality to handle the price along with easier availableness to your currency, if you is also validate remaining the brand new deposit to deal with difficulty. An enthusiastic Airbnb shelter put is actually a predetermined commission site visitors pay. It is supposed to compensate you the destroy that may exist while they’re on-site. The newest deposit try refunded for the visitor once its sit if the zero damage taken place. Airbnb allows machines to need in initial deposit to help you security damage.

Reward credits

You are looking for the best repaired deposit cost it few days. The lending company away from Asia happens to be giving step three.00 per cent p.a great. To possess a positioning out of $five-hundred to have a time period of about three months — truth be told an easy task to do, with regards to the lowest put amount and deposit several months. Create note that you ought to get this to deposit thru cellular banking to love that it rates.

The brand new formula from exposure for every P&I membership try separate should your home loan servicer or financial investor has created several P&I profile in identical lender. An HSA, like most most other deposit, are insured according to the master of the money and whether or not beneficiaries have been called. When the an excellent depositor reveals an HSA and you can names beneficiaries either in the newest HSA agreement or in the lending company’s information, the newest FDIC do guarantee the fresh deposit under the Trust Account category. If the a depositor opens up a keen HSA and won’t term one beneficiaries, the newest FDIC manage ensure the brand new put under the Unmarried Account class.

Such, a great step 3-season identity deposit that have a great $one hundred,100000 minimum may offer a higher rate of interest than a 3-week term deposit having a $a thousand lowest. Now that we’ve had a look at the interest rates banking companies need to give, here’s a simple and easy report on what you need to understand fixed dumps. The highest rates private financial people will get is actually 2.40% p.a great. With the absolute minimum deposit element $20,000—somewhat for the highest front versus most other banks.

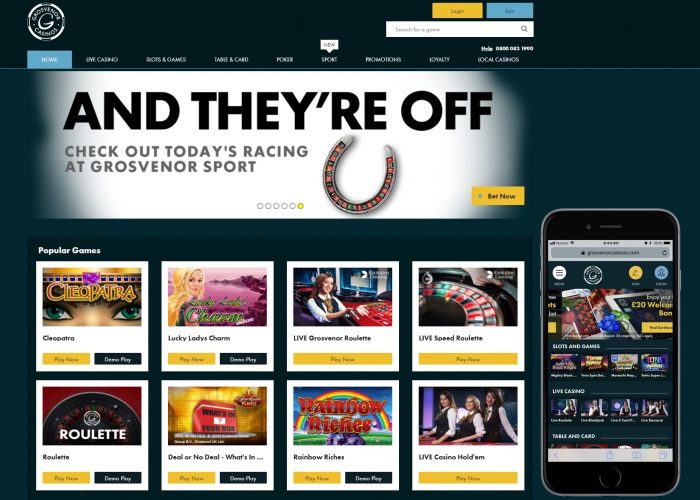

Extremely no-deposit bonuses provides betting criteria one which just withdraw one winnings. You’re unable to cash-out any winnings until such requirements was fulfilled. No-deposit incentives can also be launch profiles on the commitment and you can VIP software one to provides an extensive extent from advantages for players. Manage a new account in person through the squeeze page you’re able to through our very own link. Enrolling typically takes no more than a few minutes, you’ll expect you’ll explore your added bonus borrowing nearly immediately. No-deposit bonuses can come when it comes to incentive revolves, casino credit, award things, bonus potato chips, a predetermined-cash bonus, otherwise sweepstakes local casino incentives.

If the all of these standards try met, for each and every co-owner’s shares of any shared membership that she or he has at the same insured lender is actually extra along with her as well as the total try insured around $250,000. The newest FDIC—quick on the Federal Put Insurance Corporation—is another company of the Us authorities. The brand new FDIC covers depositors away from insured banking institutions found in the United Says contrary to the death of their deposits, when the a covered lender fails. If the cash is within the an FDIC-insured lender, you can rest assured. Because the 1934, zero depositor has shed a cent of the FDIC-insured financing. As the FDIC began operations inside 1934, the fresh FDIC sign on lender teller screen has offered since the a good symbol out of monetary safety and security.

No-put gambling enterprise incentive advantages and disadvantages

Put simply, you can lead a complete count if you are eligible as the of Dec. 1 of the calendar year. Although not, you may also are obligated to pay straight back taxes if you don’t continue to be qualified from Jan. 1 to Dec. 31 of the following year. Hardly can you initiate a different job on the Jan. step one or stop it for the Dec. 30.

Bodies Profile

While you are automatically adding finance on the HSA as a result of payroll write-offs, they claimed’t getting you’ll be able to so you can contribute a great deal to a healthcare Offers Account. But not, you are able to more than-contribute by simply making deposits outside of the payroll system. You might reserved currency this current year in the a keen HSA and you will use it 40 years of now. You may also pay for medical care will cost you out of pocket now, and use your HSA to keep to own medical will cost you inside senior years. Which have an FSA, if you do not spend money on the account by the end of the entire year, you forfeit the remaining equilibrium to your plan administrator. Businesses may offer large allowable plans to possess enrollees which want to spend a lower month-to-month advanced.

First, you’ll must hit the very least put requirement of $20,one hundred thousand. And you will subsequently, the highest rate of interest you should buy are somewhat down, at the 3.30 % p.an excellent. While repaired deposit costs struck a high out of five per cent inside January 2023, they’ve pulled a dip subsequently and you will repaired put alternatives desire a lot more tempting. It’s your decision whether we would like to bequeath finances money round the several term deposits, otherwise bare this cash in you to definitely lay. It’s likely that going for numerous smaller label places could help lose your own chance of economic losses and you can/otherwise litigation in case your poor would be to happens.